Company Profile

BPPLAS was first established as a partnership business known as Lam Guan Plastic Industries in 1990. Founded by Mr Lim Chun Yow, Mr Tan See Khim and Mr Hey Shiow Hoe, the company supplied polyethylene (PE) bags to the garment and textile industries in Batu Pahat.

Responding to the various Malaysian government incentives such as the Reinvestment Allowance under the industrialisation policy to stimulate export-oriented businesses, the original founders incorporated BP Plastics Sdn Bhd in 1991.

In 2005, BP Plastics Holding Bhd was listed on the Main Board of Bursa Malaysia, signifying the company's commitment towards continuous growth and expansion.

Since its public listing, BPPLAS' turnover has grown from RM122 million in FY2004 to RM283.9 million in FY2014. Today, BPPLAS is one of the largest Polyethylene (PE) Film manufacturers in Asian Region, supplying Stretch and Shrink films, and other PE packaging films and bags, stretching its presence to 51 countries. BPPLASexports almost 80% of its products to other Asian countries, Middle East and European countries.

Located in the Sri Gading Industrial Estate of Batu Pahat in Johor,BPPLAS has a combined land size of 15.5 acres, and operates at 2 manufacturing locations within the same vicinity with a total built-up area of 295,000 square feet. With the successful start-up of its new Cast Stretch Film production line, BPPLAS has a combined name plated production capacity of 6,500 metric tons per month. BPPLASis now capable of producing more than 150 metric tons of PE Film products to meet its worldwide customers' demand every single day, with more room to grow.

By converging the world’s best machinery and equipment together with the world's best resins, and supported by its own in-housed research and innovation capabilities, BPPLAS is able to produce revolutionary strong and thin gauged stretch film products such as "Infinity", "Clarity", "Priority" and "Hill Plus" to cater to a wide array of customers' needs and requirements.

In conjunction with its 25th Anniversary, BPPLAS is proud to present another newly developed stretch film product brand – “R-Edge”, an ultimate high end stretch film which is strong, functional and easy to use. This latest unique product is in line with BPPLAS' Vision to be the Plastics Packaging Specialist of Choice in the Asian Region.

In addition to ISO 9001, BPPLAS is also an ISO 14001 and 18001 certified Polyethylene Film manufacturer. BPPLAS has embraced the 5Ss and 3Rs at its operations, and strongly believes that through its' inculcation of the principles of Reduce, Reuse and Recycle in its daily operations, it can keep and prolong the precious limited natural resources for the future generations to use. BPPLAS has also put in place an effective recycle management system to efficiently manage all the wastes produced. Recycling helps to lower production costs, maintains competitiveness and keep the environment clean as well.

BPPLAS will continue to innovate and produce more sophisticated and cost competitive high quality packaging products for its customers worldwide and also seeks out business opportunities to further expand its growth and enhance its market position as a key plastics packaging supplier of choice in the Asian Region.

Fundamental of the company

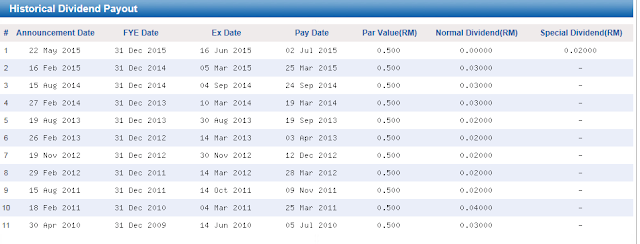

In the past 5 years, the company recorded a very stable earning and every year pay out dividend 4-5sen between 2010-2013.

In year 2014, the company also recorded earning around 5sen per share and total 6sen dividend payout on the same year.

Dividend Record

The company normally will declare dividend two times in a year which is on Feb and Aug. This year, the company has declare a special dividend of 2sen per share which ex on Jun 16 2015, if the company announce another 3sen div on Aug, this will make total dividend payout on 2015 is 8sen which is equal to 8.42%! (current price 0.95).

Net Cash

In the latest quarter which announce on May, cash in the company is 58.5m where more than double compare to last year same quarter of 26.8m. The amount of 58.5m equal to cash Rm0.32 per share.

Chart

At the above chart, the company show a very strong support at 89sen lvl and standing strong above MA100 line. I believe share can be collect during the periound between 89sen-95sen level before another new quarter report coming out.

With the recent weakening in MYR and lower input cost due to oil price fall also benefited to the company.

I believe the company can continue post a strong earning result in the coming result and give ordinary dividend of Rm0.03 per share as per previous record.

My target price- Rm1.20 (6.66% Dividend Yield base on 8sen dividend on 2015)

Happy Trading,

Regards,

Nick Loke