Gabungan AQRS Berhad (GBG) has its roots in the building and civil engineering construction. The Group's history started in 1996 when Motibina Sdn Bhd was set up as a civil and building contractor. This was followed by the establishment of Gabungan Strategik and Megah lkhlas in 1999, both of which were also involved in building and civil engineering construction. In 2003, AQRS The Building Company was established as a property development company.

These four main companies together with other companies in the Group were officially integrated under the same corporate umbrella when Gabungan AQRS Berhad was incorporated on 20th August 2010 as a Construction & Engineering service provider as well as a niche lifestyle property developer. The Group was listed on Bursa Malaysia on 31 July 2012.

GBG's core business is construction and property development is its complementary business. The Group's building and civil engineering construction activities are undertaken by Motibina. Gabungan Strategik and Megah Ikhlas while its interest in property development is spearheaded by AQRS The Building Company Sdn. Bhd.

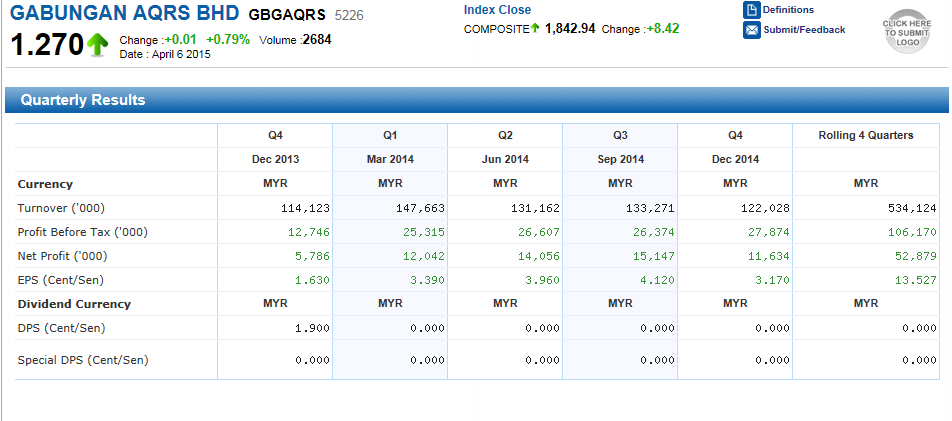

The company posted a very strong earning for FY2013 and FY2014 with earning per share with EPS 12.05sen and 13.527sen, the earning nearly double from the FY2012 which is 6.75sen. Revenue of the company also increased nearly Rm100m every year since 2012 until 2014.

From the above picture, we can see that around 7.04% shares was floating outside for public only.

If you plan to buy the shares, you need to slowly collect due to share floating to public very low.

From the chart above, the price currently on the consolidation period and standing strong above the MA69 line. Is a good time to collect during this period and waiting a better FY 2015 report coming.

FY2015

On March 2015, the company announced joint venture with Suria Capital Holdings Bhd to develop a seven acre area in Sabah. The site which is to be known as One Jesselton Waterfront will be developed into a mixed development which has a net sale value of RM1.8 billion. GBG owns 82% of this project while Suria Capital holds the remainder.

Research house Affin Hwang Capital concurred and highlighted that the construction division still has an outstanding orderbook of RM600 million to RM700 million and noted that the group is still aiming for more contract wins in west and east Malaysia. (TP: Rm1.77)

MIDF Research house has a positive outlook on the sector for 2014, the company might also be able to capitalise on a strong construction sector in FY2015 with recently noted that the sector has already received Rm3.5 billion worth new jobs ( More than Double) compare to Rm1.4 billion posted in the first quarter last year.

Estimated earning for FY2015 is 17.7sen (30% increase) by CIMB research.

With the above all positive outlook for the company,

Short Term Target : Rm1.48

Medium Term Target : Rm1.74

Happy Trading!

Regards,

Nick Loke

No comments:

Post a Comment