No 1.

Affin ( 5185) banking stock,share price slowly recovering from bottom and earning growing in the latest 2 quarter. Company target to achieve better result in coming year, dividend payout last year was 8sen. Target dividend this year will at least 8sen and above.

No2.

Cepat (8982), a plantation company, one of the Cold Eye's recommended stock in 2015. Share price has up nearly 50% in latest 3 months after the company posted a good earning report in q3 2016 with eps of 3.37sen per shares. Recently CPO price has gone to Rm3200 level compare to last year around Rm2500 level in August. I believe cepat wawasan group berhad will continue with good result in the coming quarter with the high level of CPO price.

No3.

Favco (7229) oil and gas counter, company's share price has fallen from high Rm3.95 mainly due to fallen in oil price. Even with the low oil price, the company still posted a very good earning and strong cash in hand. The company's dividend payout has been increasing over the past 3 years from 10sen to 15sen last year. Based on the current price, the company trading at single digit PE and dividend yield around 6%.

No4.

Fimacor (3107), major in printing business, very stable earning company and cash rich in hand. Revenue and earning has been growth up in the past 3 quarter. Plantation also one of the business of the company. Raising of CPO price also will benefited to the company. Currently company trading at single digit PE and dividend payout 12.5sen in past two years (6% yield). Company share price has been fall down all the way after bonus issue has done on 2014.

No5.

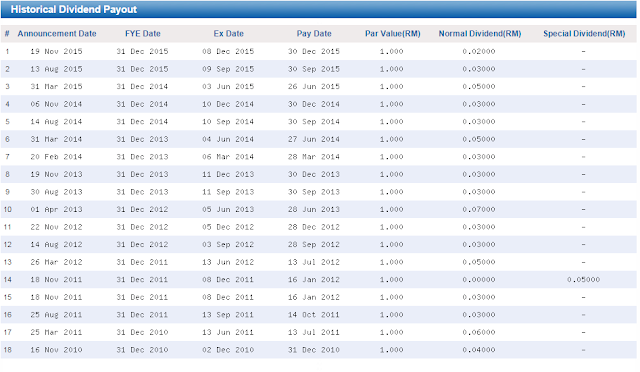

FPI (9172), manufacturing sound system and musical instrument. The company has a very healthy balance sheet with cash of 62sen per shares. One of the major shareholders is Permodalan Nasional Berhad. Last year dividend payout 7sen which translate to 8% yield. The company has high accumulated earnings and good dividend payout in the history.

No6.

No7.

Hsplant (5138), plantation company. The company has a solid balance sheet and attractive valuations. High CPO price will benefit the company and the share price also side way for very long time even the CPO has been surge to Rm3200 compare to Rm2500 a year ago.

No8.

Lonbisc (7126), confectionery manufacturing company. Company revenue has been steady growth in the past few years. One of the famous layer cake and swiss roll in market. Company recently has new production line in potato chips and target to be better earning in the future.

No9.

Spritzer (7103), manufacturing and distribution of drinking water. The company has been steady growth in the past 5 years and entered China market last year. Stable earning grow in Malaysia and potential benefited in China market.

No10.

Suncon (5263), construction company. Steady earning and high outstanding order book with provision of earning visibility for the coming 3 years. Good management team and potential more project in the 2017