Media Prima Berhad (Media Prima), a company listed on the Main Market of Bursa Malaysia, is Malaysia’s leading fully-integrated media group. The Group is also one of Malaysia’s Top 100 largest listed companies by revenue.

The Group has equity interests in TV3, 8TV, ntv7 and TV9. In addition, the Group also owns more than 98 percent equity interest in The New Straits Times Press (Malaysia) Berhad (NSTP), Malaysia’s largest publisher with three national newspapers; New Straits Times, Berita Harian and Harian Metro.

The Group has strong online presence through its digital media subsidiary, Media Prima Digital, via the entertainment portal gua.com.my, women’s lifestyle portal seroja.com.my and tonton.com.my, the No. 1 Malaysian video portal with HD-ready quality viewing experience that offers the individualism of customised content and interactivity of social networking, which now has close to 4 million registered users.

The Group has strong online presence through its digital media subsidiary, Media Prima Digital, via the entertainment portal gua.com.my, women’s lifestyle portal seroja.com.my and tonton.com.my, the No. 1 Malaysian video portal with HD-ready quality viewing experience that offers the individualism of customised content and interactivity of social networking, which now has close to 4 million registered users.

Emas is the first classic channel in Malaysia showcasing Media Prima’s production of popular TV programmes and is available on platforms such as HyppTV and ABN. The Group also owns three radio stations, Fly Fm, Hot FM and one FM.

The Group’s leadership position in the Out-of-Home Advertising business is represented by Big Tree Outdoor Sdn. Bhd., UPD Sdn. Bhd., The Right Channel Sdn. Bhd., Kurnia Outdoor Sdn. Bhd. and Jupiter Outdoor Network Sdn. Bhd.

The Group also owns a content creation subsidiary, Primeworks Studios Sdn Bhd, Malaysia’s largest production company, producing TV content and feature films since 1984 and 1994 respectively.

Company Earning,

The company announced net loses on Q4 2014 was mainly due to a one time expenses on Mutual separation scheme, where this will help the company reduce their expenses and salary payout in future. And yes, the company is turn back to profit on the next quarter which is Q1 2015 and the result is getting better and better in Q2 and Q3 2015.

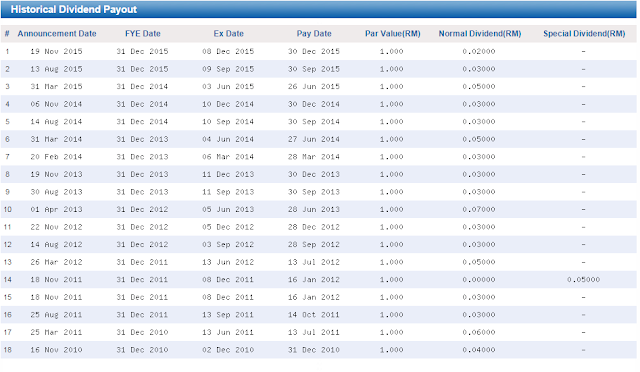

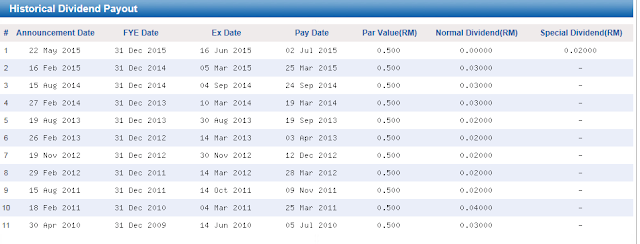

Dividend,

From the picture above, we can see that Media Prima one year payout 3 times dividend, and total dividend payout on 2015 is 10sen! Based on current price of Rm1.35, dividend yield is 7.4%!

Latest Quarter report,

In the latest quarter announce, the company did a repayment of redeemable fix rate bonds of total Rm150mil and after deduct the amount, net cash position if Rm 395mil which around 35sen per share due to the company have nearly 0 short term loan.

Chart,

Company share price is getting better after all the way down from last year Rm 2.60 til September 2015 with lowest price at Rm 1.04. Share price movement has break the downtrend line and currently at uptrending line with strong support at Rm 1.30. We also can see that, on July 2015, a huge volume transacted on the week which is around 20 mil shares traded (Rm1.30 - Rm1.44) and now strong standing around the price level.

Summary,

1) With the avg earning of around 3.9sen each quarter, company could stand at around PE 8.65 only (total earning 3.9x4 =15.6sen base on price Rm1.35)

2) Attractive dividend yield 7.4% (10sen div)

3)Share price at bottom, nearly 50% lower compare to last year high Rm2.60

4) Cheap price compare to ASTRO (PE 25.42, Dividend yield 4.21%)

My Medium Target Price : Rm2.00 (PE 12.82, Dividend Yield: 5%)

Happy Trading!

Regards,

Nick Loke